42 present value formula coupon bond

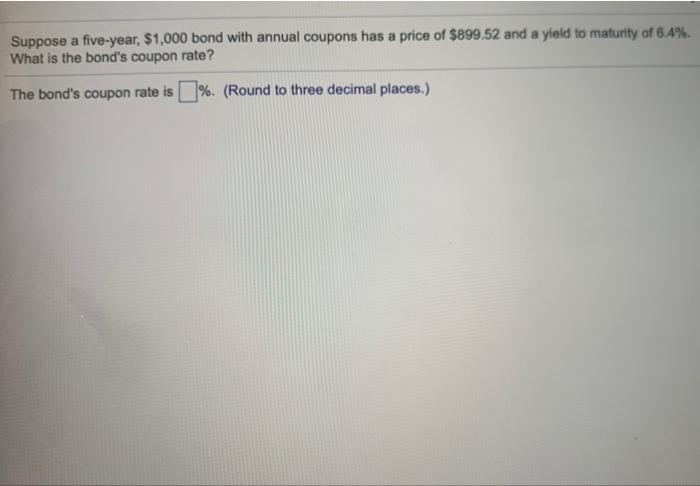

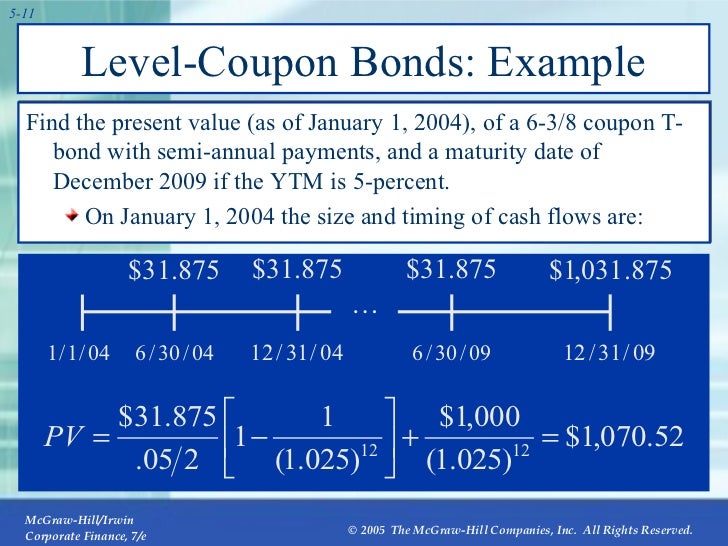

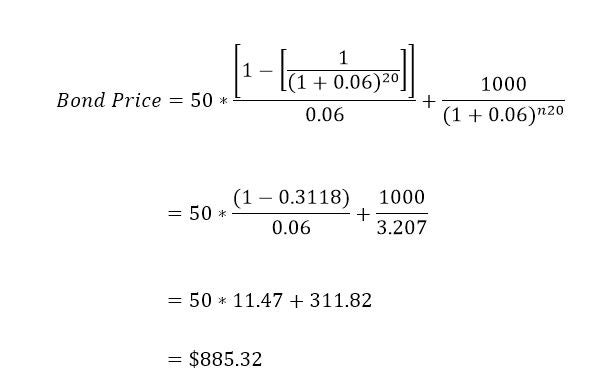

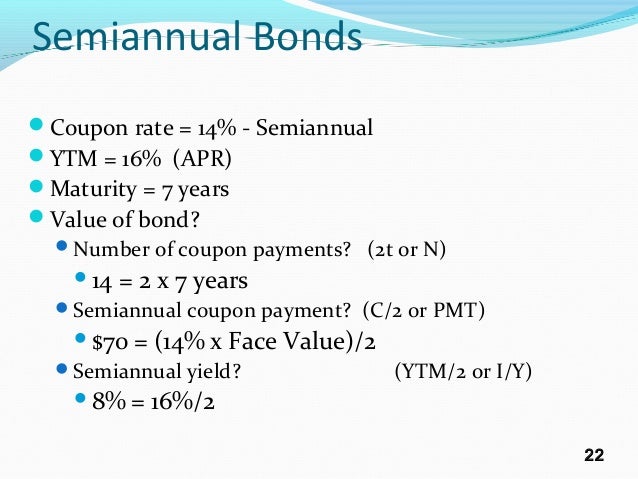

Bond Pricing Formula | How to Calculate Bond Price? | Examples Let us assume a company XYZ Ltd has issued a bond having a face value of $100,000, carrying an annual coupon rate of 7% and maturing in 15 years. The prevailing market rate of interest is 9%. Given, F = $100,000 C = 7% * $100,000 = $7,000 n = 15 r = 9% The price of the bond calculation using the above formula as, Bond price = $83,878.62 Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates

Deriving the Bond Pricing Formula - Invest Excel the coupon payment is divided by F. the interest rate is divided by F. the number of payments is multiplied by F. The bond pricing formula then becomes. As the payment frequency F increases, the bond value increases. This formula can be rearranged to give the number of payments n. The bond pricing equation cannot be rearranged to give an ...

Present value formula coupon bond

How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,... Annuity: Excel Calculator and Present Value (PV) Formula Annuity Formula - Present Value (PV) of Bond. The formula for calculating the present value (PV) of an annuity is equal to the sum of all future annuity payments - which are divided by one plus the yield to maturity and raised to the power of the number of periods. Present Value (PV) of Annuity Bond Formula. PV = Σ A / (1 + r) ^ t; Where:

Present value formula coupon bond. Bond Formulas - thismatter.com The most common bond formulas, including time value of money and annuities, bond yields, yield to maturity, and duration and convexity. ... Bond Value = Present Value of Coupon Payments + Present Value of Par Value. Duration Approximation Formula; Duration = P-- P + 2 × P 0 (Δy) P 0 = Bond price. Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond's interest payments, PLUS The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value. Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Par Bond - Overview, Bond Pricing Formula, Example A bond with a face value of $100 and a maturity of three years comes with a coupon rate of 5% paid annually. The current market interest rate is 5%. Using the bond pricing formula to mathematically confirm that the bond is priced at par, Shown above, with a coupon rate equal to the market interest rate, the resulting bond is priced at par.

Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the... Bond Formula | How to Calculate a Bond | Examples with Excel ... - EDUCBA PV of kth Periodic Coupon Payment = (C / n) / (1 + r / n) k PV of Face Value = F / (1 + r / n) n*t Step 7: Finally, the bond formula can be derived by adding up the PV of all the coupon payments and the face value at maturity as shown below. Bond Price = C * [ (1 - (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. How to Calculate Present Value of a Bond in Excel (3 Easy ... For Zero Coupon Bond — To calculate the present value of a zero-coupon bond, we take a ... Then, write down the following formula in the formula box.

Bond valuation - Wikipedia Present value approach. Below is the formula for calculating a bond's price, which uses the basic present value (PV) formula for a given discount rate. This formula assumes that a coupon payment has just been made; see below for adjustments on other dates. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Bond Valuation | Meaning, Methods, Present Value, Example | eFM Present Value n = Expected cash flow in the period n/ (1+i) n Here, i = rate of return/discount rate on bond n = expected time to receive the cash flow This formula will get the present value of each individual cash flow t years from now. The next step is to add all individual cash flows. How to Figure Out the Present Value of a Bond - dummies Use the present value factors to calculate the present value of each amount in dollars. The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond.

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow to arrive at the present value of the principal at maturity. For this example, PV = $1000/ (1+0.025)^10 = $781.20. Add the present value of interest to the present value of principal to arrive at the present bond value. For our example, the bond value = ($467.67 + $781.20), or $1,248.87.

How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

Valuing Bonds | Boundless Finance | | Course Hero F = face value, i F = contractual interest rate, C = F * i F = coupon payment (periodic interest payment), N = number of payments, i = market interest rate, or required yield, or observed / appropriate yield to maturity, M = value at maturity, usually equals face value, and P = market price of bond.

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

Solved If a stock pays a constant annual dividend then the - Chegg This problem has been solved! See the answer. If a stock pays a constant annual dividend then the stock can be valued using the: a) perpetuity present value formula. b)present value of an ordinary annuity formula. c) payout ratio formula. d) fixed coupon bond present value formula. e) present value of an annuity due formula.

Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments)

How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

Annuity: Excel Calculator and Present Value (PV) Formula Annuity Formula - Present Value (PV) of Bond. The formula for calculating the present value (PV) of an annuity is equal to the sum of all future annuity payments - which are divided by one plus the yield to maturity and raised to the power of the number of periods. Present Value (PV) of Annuity Bond Formula. PV = Σ A / (1 + r) ^ t; Where:

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

Post a Comment for "42 present value formula coupon bond"