42 coupon rate semi annual

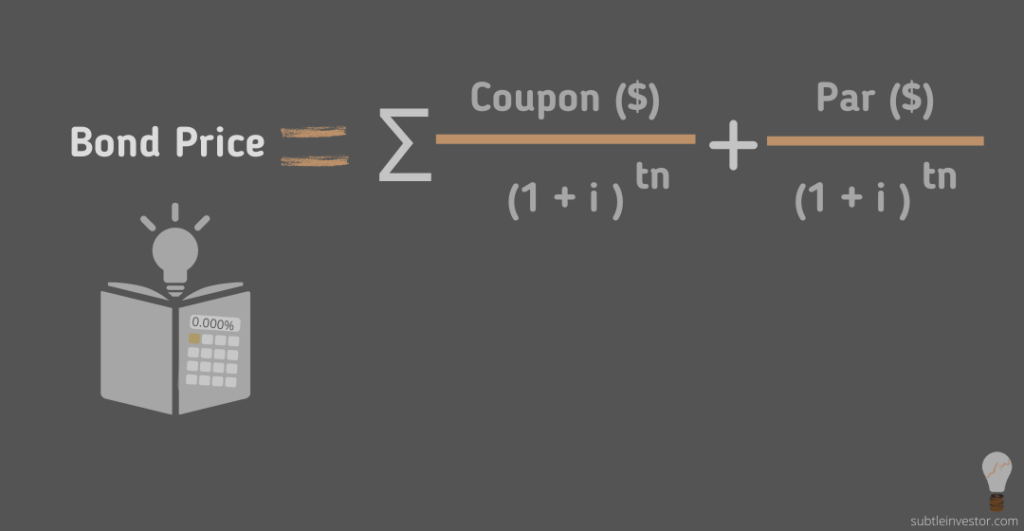

What is a Coupon Rate? | Bond Investing | Investment U Coupon Rate = Total Coupon Payments / Par Value. For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. Rates come fixed from the point of issuance; still, it's important to understand how to calculate them when evaluating fixed-income investments through different lenses ... Semiannual coupon and annual coupon | Forum | Bionic Turtle The meaning of 10% semiannual coupons is that the bond pays coupon at 10% of face value per year compounded semiannually. So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half ...

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Coupon rate semi annual

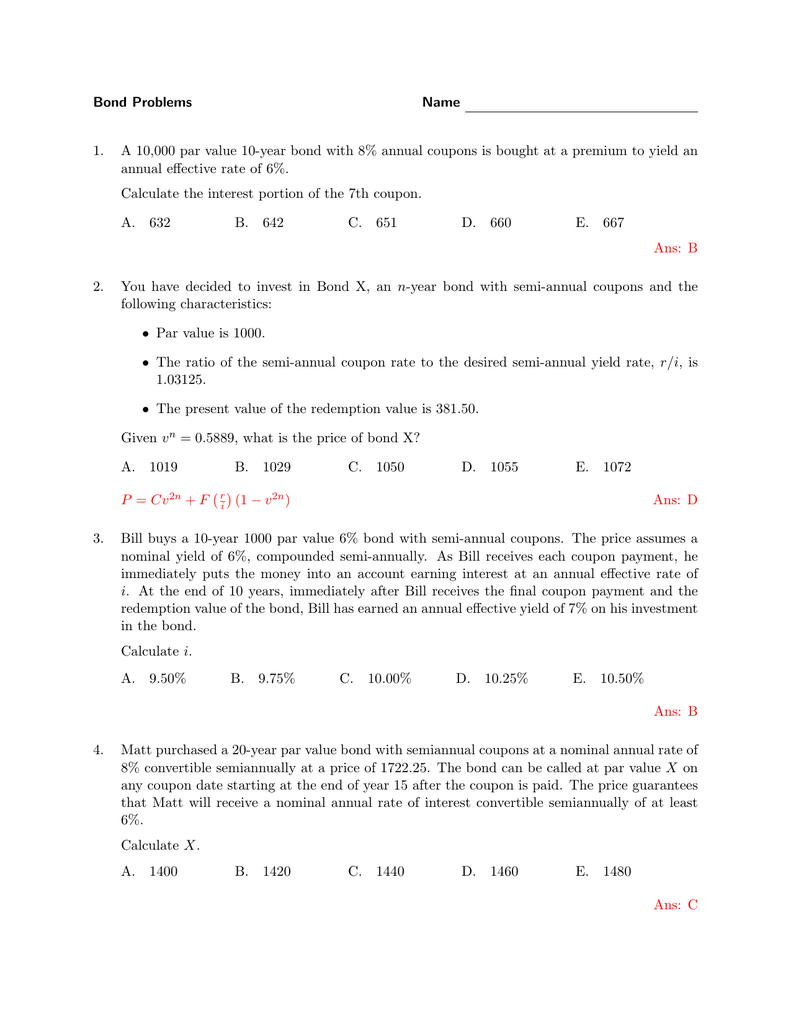

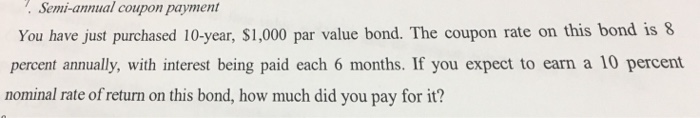

How to Calculate a Bond | Examples with Excel Template - EDUCBA Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. › Calculate-Annual-Interest-on-Bonds3 Ways to Calculate Annual Interest on Bonds - wikiHow Mar 29, 2019 · To calculate the annual interest, you need to know the coupon rate and the price of the bond. For example, Company QRS issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 10 percent, so the bond is issued at par.

Coupon rate semi annual. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Therefore, the coupon rate for the Company A bond is 20%. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. Solved What must be the price of a $1,000 bond with a 8% - Chegg Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback to keep the quality high. Par value = $1000 Coupon rate = 8% Coupon payment = Semiannual Coupon amount = (1000 * 0.08 ) / 2 Coupon amount = $40 Time to maturity = 6 years Number of coupon payment = 6*2 …. View the full answer. › calculators › financialAPR Calculator The Advanced APR Calculator finds the effective annual percentage rate (APR) for a loan (fixed mortgage, car loan, etc.), allowing you to specify interest compounding and payment frequencies. Input loan amount, interest rate, number of payments and financing fees to find the APR for the loan.

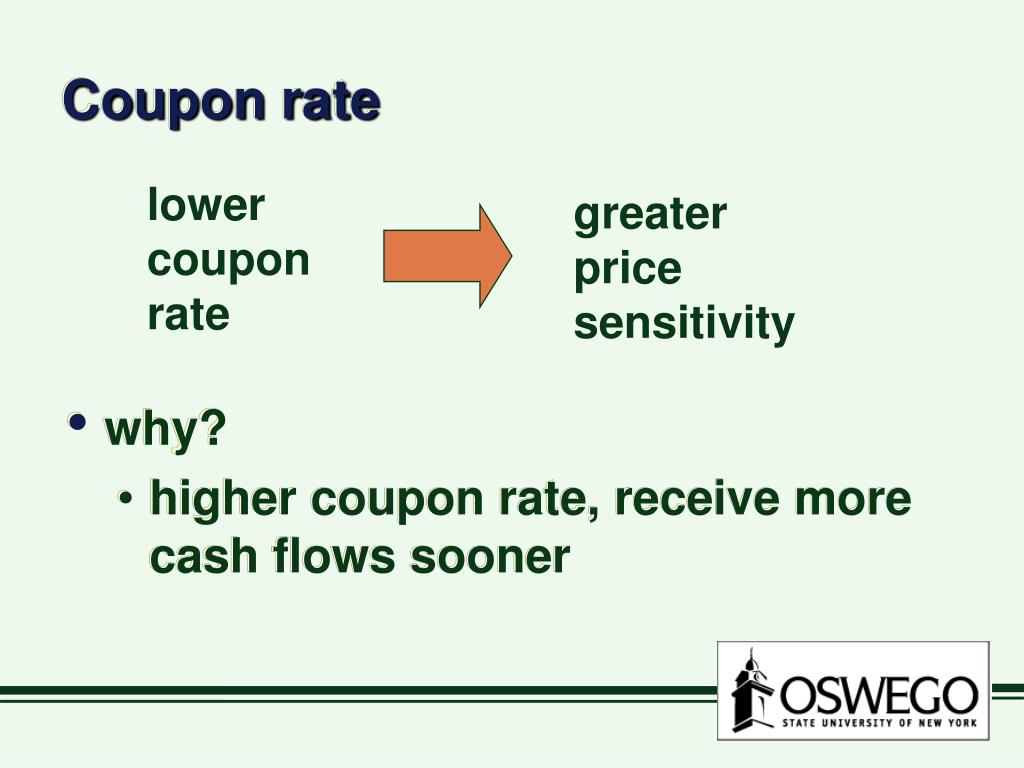

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... In addition to getting semi-annual interest payments, bond issuers promise to repay the face value of bonds to investors at maturity. ... Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent ... Semi-Annual Coupon Rate Definition | Law Insider Related to Semi-Annual Coupon Rate. Semi-Annual Period means each of: the period beginning on and including January 1 and ending on and including June 30; and the period beginning on and including July 1 and ending on and including December 31.. Coupon Rate has the meaning set forth in Section 2.8.. Average Annual Bonus means the average of the annual bonuses from the Company earned by the ... Solved Suppose a seven-year, $1,000 bond with a 7% coupon | Chegg.com This problem has been solved! Suppose a seven-year, $1,000 bond with a 7% coupon rate and semi-annual coupon is trading with a yield to maturity of 5%. (5 points) a)Is this bond currently trading at a discount, at par or at a premium? Explain. (1.5 points) b)If the yield to maturity of the bond rises to 5.5% (APR with semi-annual compounding ... Bond Prices: Annual Vs. Semiannual Payments - Pocketsense A bond with semiannual payments would have a higher price than a bond with annual payments when they both are selling at a premium. Bonds can sell at a premium only when their market interest rates are lower than the coupon rate. In general, bonds with semiannual payments are more sensitive to changes in market interest rates.

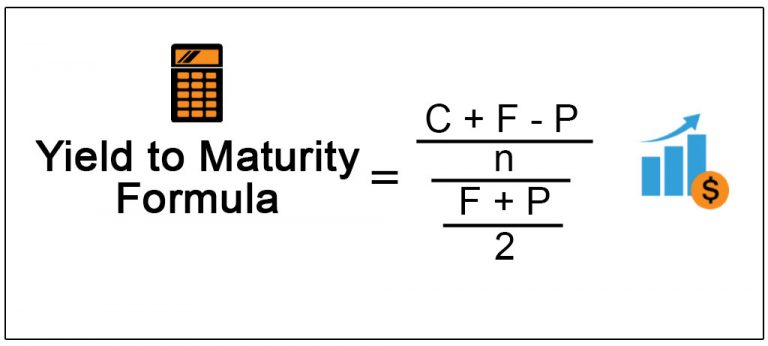

› terms › eEffective Yield Definition - Investopedia Mar 23, 2020 · Effective Yield: The effective yield is the yield of a bond which has its coupons reinvested after payment has been received by the bondholder. Effective yield is the total yield an investor ... › apr-APR Calculator APY can sometimes be called EAPR, meaning effective annual percentage rate, or EAR, referring to the effective annual rate. The main difference between APY and APR is that the former considers yearly compounded interest while APR always means a monthly period. Thus, at the equivalent rate, APR appears lower than the APY assuming positive rates. What Does Semiannual Mean? | Examples, Summary Example 2 - Interest rate. Interest is sometimes stated for six months. If a semi-annual interest rate of 6% is calculated per year, it would mean that the overall interest rate that you will pay is 12%. Let's look at Jane's Travel, Jane borrows $100,000 from the bank with a 6% semi-annual interest payment. To calculate the interest per ... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

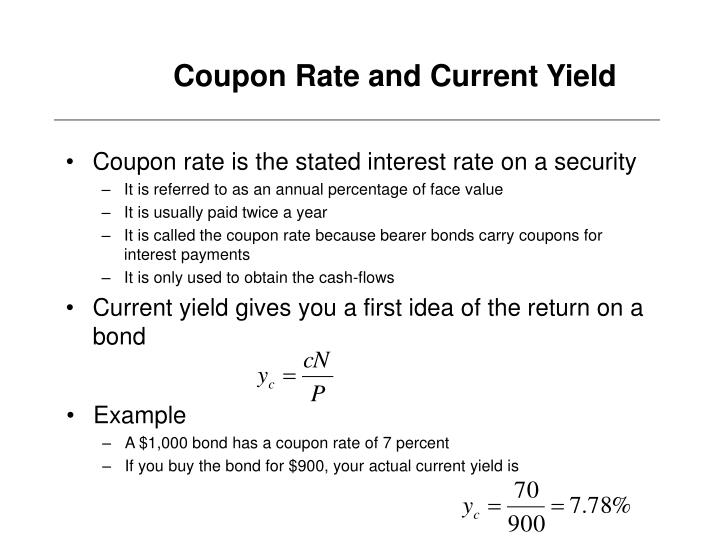

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. ... As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment ...

Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100.

What Is Coupon Rate and How Do You Calculate It? A bond with semi-annual to annual coupon payments can provide a steady stream of income with the right coupon rate. ... To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays ...

How to Calculate Semi-Annual Bond Yield | Pocketsense To calculate the semi-annual return rate of your bonds, you can utilize a series of simple calculations. These include dividing the annual coupon rate in half, calculating the total number of compounding periods, and multiplying the bond's current face value by the semiannual interest rate in order to determine the semiannual payment amount.

Semi-annual rate - ACT Wiki Coupon rates on bonds paying interest twice per year are generally expressed as semi-annual rates. ... Example: Semi-annual rate calculation. For example if the semi-annual rate is quoted as 4%, then the periodic interest accruing is: = 4% x (6/12) = 2% per six month period. A semi-annual rate is an example of a nominal annual rate.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80.

› knowledge-center › how-to-calculateHow to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · For instance, in the example above, an investor who bought the bond for $900 would get $10 semi-annual interest payments for five years, but would then get $1,000 at maturity -- adding another ...

A bond has an 8% coupon rate (semi-annual interest), a maturity value ... Answer (1 of 5): 1 - You have to find the present value(PV) of the bond's face value of $1,000 using this formula: 2 - PV =FV/[1 + R]^N, where FV=Future value, R=Interest Rate per period, N=Number of periods. 3 - You have to find the PV of the stream of coupons using this formula: PV = P*(((1 +...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

How to Calculate the Price of Coupon Bond? - WallStreetMojo It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 ...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

› terms › fWhat Is a Fixed-Rate Bond? - Investopedia Mar 31, 2021 · Fixed-Rate Bond: A fixed-rate bond is a bond that pays the same amount of interest for its entire term. The benefit of owning a fixed-rate bond is that investors know with certainty how much ...

Post a Comment for "42 coupon rate semi annual"