40 present value of zero coupon bond calculator

Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM Zero-Coupon Bond Value Calculator This online calculator is used to calculate the zero-coupon bond price, yield to maturity and spending power at maturity. Face value at maturity ($) Interest rate (APR %) Years to maturity Months to maturity Annual inflation rate (%) Marginal income tax rate (%) Results... Zero Coupon Bond Price = $914.54 How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Zero Coupon Bond Effective Yield Calculator Zero Coupon Bond Effective Yield Solution STEP 0: Pre-Calculation Summary Formula Used Zero Coupon Bond Effective Yield = (Face Value/Present Value)^ (1/Number of Periods)-1 ZCB Yield = (F/PV)^ (1/n)-1 This formula uses 3 Variables Variables Used Face Value - Face value is the nominal value or dollar value of a security stated by the issuer.

Present value of zero coupon bond calculator

Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Present value of zero coupon bond calculator. How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =... Present Value (PV) Definition - Investopedia Feb 01, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Zero Coupon Bond Value Calculator - buyupside.com Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Zero-Coupon Bond Value Formula M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. Zero Coupon Bond Calculator Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0%) ^ 20. PV = $554. The price of this zero-coupon is $554, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return.

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Present Value Annuity Factor (PVAF) Calculator - StableBread Zero Coupon Bond Value Calculator; Debt and Loans. After-Tax Cost of Debt Calculator; ... Calculator; Present Value of Annuity Continuous Compounding (PVACC) Calculator;

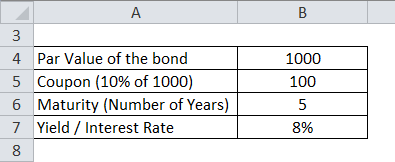

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Present Value Calculator Present Value. Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. Net Present Value. A popular concept in finance is the idea of net present value, more commonly known as NPV.

Zero Coupon Bond Calculator – What is the Market Value? Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.

c) Calculate the Present Value of a zero-coupon bond | Chegg.com Expert Answer Transcribed image text: c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. an Previous question

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face ...

Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value. i ...

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

Post a Comment for "40 present value of zero coupon bond calculator"