38 are zero coupon bonds taxable

Taxation Rules for Bond Investors--A Taxing Issue Zero-coupon bonds are issued by governments at discounts and they mature at par values, where the amount of the spread is divided equally among the number of years to maturity. They are... Zero Coupon Municipal Bonds: Tax Treatment - TheStreet If the bond is taxable, the annual accruals will be reported to you on a 1099-OID form and you have to pay income tax on them. That's why many people opt to hold taxable zero-coupon bonds in...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Are zero coupon bonds taxable

› corporate-bondsCorporate Bonds India- Invest in Corporate Sector Bonds Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond , others are considered as Non-investment Grade Bond. Coupon rate : Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7%(AAA rated) to 12%(A rated) coupons in the current year 2021. On the contrary, G-secs provide 6% coupon rate. › ask › answersHow Are Municipal Bonds Taxed? - Investopedia Jan 17, 2022 · However, most zero-coupon municipal bonds are sold in denominations of $5,000. Either way, you’re buying at a tremendous discount. This, in turn, allows you to buy more bonds if you so desire. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Are zero coupon bonds taxable. Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax. As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond-. (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day ... study.com › learn › zero-coupon-bond-questions-andZero Coupon Bond Questions and Answers | Study.com A $60,000 portfolio is constructed with $10,000 used to buy 2-year zero coupon bonds, $20,000 used to buy 5-year zero coupon bonds, and $30,000 used to buy 10-year zero coupon bonds. The yield rate... How to Invest in Zero-Coupon Bonds | Bonds | US News The problem can be avoided with a tax-free municipal zero-coupon bond, or by holding the zero in a tax-preferred account like an individual retirement account. Volatility is a second issue. Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia Zero-Coupon Bonds. A zero-coupon bond is a type of bond that earns no interest during its lifetime. A zero-coupon bond is issued with a sudden reduction in par value or face value, which is the amount that will be paid for the bond at maturity. An investor receives a one-time interest payment at maturity equal to the difference between the face ...

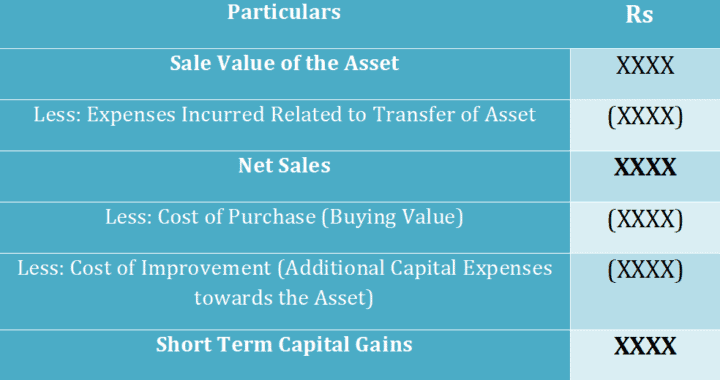

Zero Coupon Bonds (ZCB) & its taxation in the hands of investor Income arising from zero coupon bonds shall be taxed only in the year in which same is transferred or redeemed or matured. The income arising from transfer of zero coupon bonds could be either Short Term Capital Gain (STCG) or Long Term Capital Gain (LTCG) depending upon the period of holding. PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) payments. First the yield needs to be calculated. We will present a simplified three year zero coupon bond as an example. The taxable zero coupon bond is purchased for P = $900 with a value at maturity M = $1000 in three years. Let y = yield so that (1) 900(1 + y)3 = 1000, y = 1 1000 3 900 ªº «»¬¼ - 1 = .0357442 = 3.57442% . Next the (phantom The ABCs of Zero Coupon Bonds | Tax & Wealth Management, LLP Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is called "phantom income." Target Dates For individuals, zero coupon bonds may serve several investment purposes. Taxes and zero coupon bonds - FMSbonds.com Tax-exempt interest earned on zero coupon bonds should be reported on your 1040, along with all other tax-exempt interest received. The interest reported is based on the original issue price and yield or, as you stated, "the bond's original accretion."

What is zero coupon bonds? - Zaviad Zero-coupon muni bonds offer tax-free investment growth. However, you should be aware that the interest you earn will be taxed if you sell the bond at a higher price than the issue price. In such a case, zero-coupon muni bonds may be the better choice. The tax implications of zero-coupon muni bonds are minimal. › article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period. Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... Figuring OID on Long-Term Debt Instruments Zero coupon bonds. Form 1099-OID. Form 1099-OID not received. Reduction for acquisition premium. Transfers during the month. Debt Instruments Issued After July 1, 1982, and Before 1985 Debt Instruments Issued After 1984 Contingent Payment Debt Instruments Inflation-Indexed Debt Instruments

Impact of Taxation on Zero-Coupon Muni Returns Most zero-coupon munis bonds are tax exempt, as they are purchased at deep discounts and don't make any periodic coupon payments. This is often favorable for investors in higher tax brackets who are looking for investment growth over regular income.

Solved: Zero coupon municipal bonds maturation The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond.

Zero Coupon Bond Interest Taxable - jnglsw.live Zero Coupon Bond Interest Taxable, 100 Coupon To Open A Chase Checking Account, Cashmere Bathroom Tissue Printable Coupon Canada, Deals Cake Pops, 10 Percent Off Best Buy Coupon Code, Sephora In Store Coupons Printable 2020, Coldwater Creek Coupon Nov 2020 ...

How is tax calculated on a zero coupon bond? - Quora Answer (1 of 5): Great question. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount a bond will be worth when it "matures" or comes due. When a zero coupon bond ...

Zero Coupon Bonds | Tamar Securities Financial Por Taxable Bonds Zero-Coupon Bonds. Zero-coupon bonds are issued at a discount to face value and gradually accrue value to maturity. Zero-coupon bonds do not pay regular interest payments and mature at par ($1,000) for one lump sum payment. Corporations, municipalities, and the US Treasury issue zero-coupon bonds. Even though investors do not ...

› wealth-management › adviceUS Treasury Securities - Taxable Bonds | Raymond James Like other zero-coupon bonds, bills are generally sold at a discount from par value. Notes are intermediate-term investments with maturities from two to 10 years at the time of issuance. These securities have a stated interest rate, make semi-annual payments, and may be purchased to meet future expenses or provide additional retirement income.

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips Zero-coupon bonds are a special case. You might have to pay tax on their interest income — even though you don't actually receive any interest. With a zero-coupon bond , you buy the bond at a...

How is a zero-coupon bond taxed? - Terasolartisans.com Zero coupon municipal bonds ("zeros") are tax-exempt, intermediate- to long-term bonds purchased at a deep discount. With zero coupon municipal bonds, the compounded interest is exempt from federal income taxes and, in some states, is also free from state income taxes to residents in the state of issuance.

Post a Comment for "38 are zero coupon bonds taxable"