42 zero coupon bond value

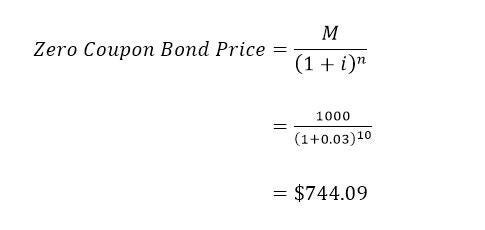

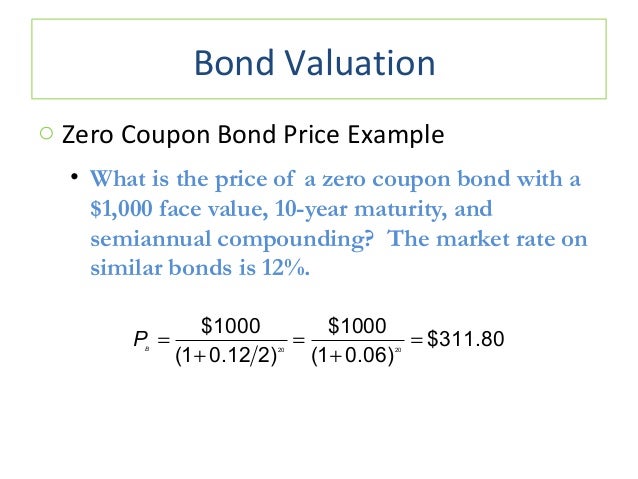

Zero-Coupon Bond: Formula and Excel Calculator To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Zero Coupon Bond Yield: Formula, Considerations, and ... Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =...

Zero - definition of zero by The Free Dictionary Define zero. zero synonyms, zero pronunciation, zero translation, English dictionary definition of zero. n. pl. ze·ros or ze·roes 1. The numerical symbol 0; a cipher. 2.

Zero coupon bond value

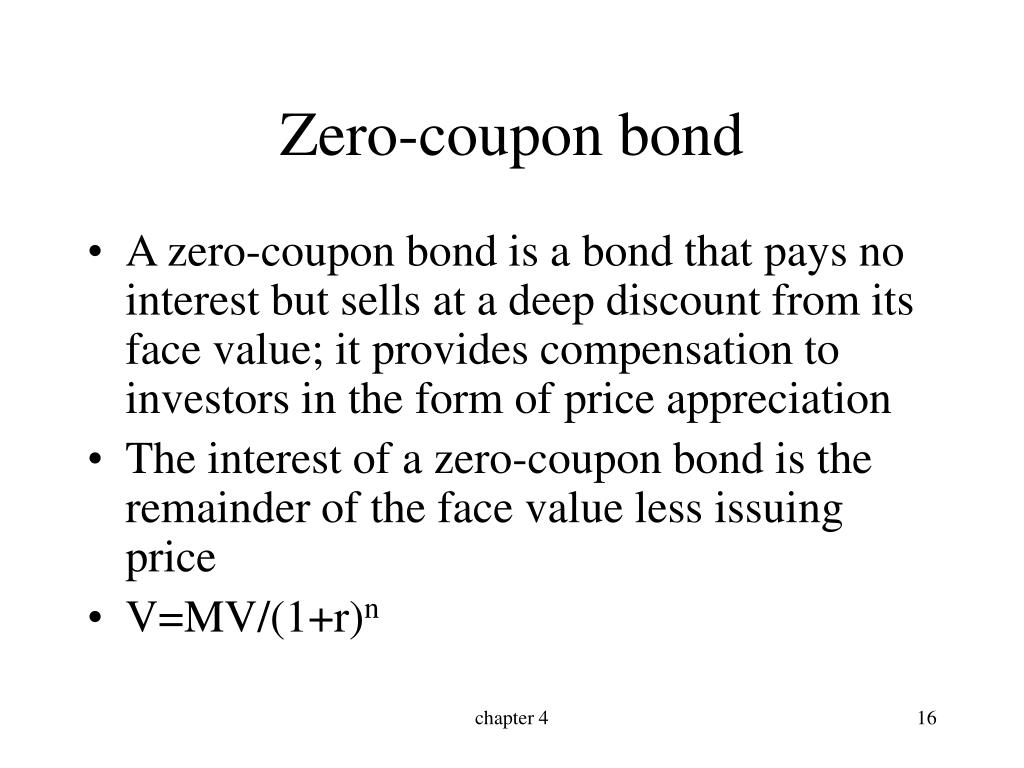

Solved You find a zero coupon bond with a par value of ... You find a zero coupon bond with a par value of $10,000 and 13 years to maturity. If the yield to maturity on this bond is 4.7 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Bond price Solved: A zero-coupon bond with face value $1,000 and ... A zero-coupon bond with face value $1,000 and maturity of five years sells for $746.22. What is its yield to maturity? What will happen to its yield to maturity if its price falls immediately to $730? Step-by-step solution 100% (54 ratings) for this solution Step 1 of 3 Zero Coupon Bond - Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero coupon bond value. Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that … Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of … Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity … Zero-Coupon Bond Value | Formula, Example, Analysis ... The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations.

Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ... 14.3 Accounting for Zero-Coupon Bonds – Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Value and Yield of a Zero-Coupon Bond | Formula & Example Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

Answered: Suppose that all bonds have $1,000 of… | bartleby Suppose that all bonds have $1,000 of face value. The current prices of zero coupon bonds are as follows: $960 for a one-year bond; $910 for a two-year bond; $850 for a three-year bond. a.

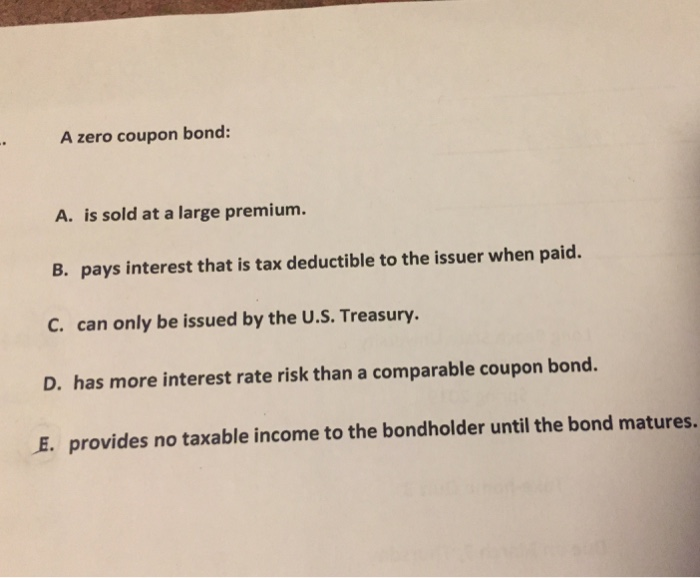

17 If the discount rate increases the value of a zero ... 17 If the discount rate increases, the value of a zero-coupon bond will: A increase. decrease. remain unchanged.B C Chapter 9 Debt Securities. 18 A bond's current yield is calculated as the annual coupon payment divided by its: A par value. yield to maturity. current market price.B C.

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

A zero-coupon bond with a face value of $1,000 | Chegg.com Finance questions and answers. A zero-coupon bond with a face value of $1,000 matures in 7 years and sells for $500: (i) Without doing calculations, estimate its yield to maturity (ii) Calculate its yield to maturity (using semi-annual periods)

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond: Definition, Formula & Example - Video ... A newly issued 20-year maturity, zero-coupon bond is issued with a yield to maturity of 6.5% and face value $1,000. Find the imputed interest income in the first, second, and last year of the bond's l

Zero Coupon Bond Value Calculator | Restaurant le Garde Manger 20 year, 7% coupon bond D. 20-year, 9% coupon bond E. Cannot tell from the information given. 7-year, 0% coupon bond B. 7-year, 12% coupon bond C. 7 year, 14% coupon bond D. 7-year, 10% coupon bond E. Just remember, the higher the duration, the more sensitive the bond is to interest rate changes, and thus, the more prone it is to interest rate ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Value Formula: How to Calculate Value of ... Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. katex is not defined YTM of this bond is 4.83%.

Zero Coupon Bond Calculator - MiniWebtool A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Zero-Coupon Swap Definition - Investopedia 26.8.2021 · Zero Coupon Swap: A zero coupon swap is an exchange of income streams in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap , but the ...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

Zero Coupon Bond Value Calculator - Find Formula, Example ... Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5 When we solve the equation barely by hand or use the calculator we put up, the product will be Rs.747.26. So, the original price of the share in question is Rs.747.26, which can then be redeemed at a face value of Rs.1000. What is the use of Zero Coupon Bond Value Calculator?

Zero Coupon Bonds - Financial Edge Training Calculating the value of a zero coupon bond. What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns.

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "42 zero coupon bond value"